Kevin O’Leary’s four reasons to cut holiday spending: keep more by giving less

An old holiday adage says that it is better to give than to receive. I disagree. Giving is costly. This holiday season, give your kids the lasting gift of common sense instead of the short-term satisfaction of their entire wish list. Read my four reasons for why you should cut down on the time and money you spend at the mall during the holidays.

1. Don’t spoil the holidays by spoiling your kids

I fly first class and though my kids often travel with me, they fly coach. They need to learn the importance of scarcity. Even if you’ve been lucky enough to be successful, you shouldn’t use that as an excuse to spoil your children. I don’t. I know that for them to relate to the rest of the world, they have to know what it’s like to struggle and work hard. The incentive to work hard is non-existent if you grow up with everything you could possibly want handed to you. Conversely, the incentive to work hard is strong if you’re taught the importance of scarcity from a young age.

I’m not saying you shouldn’t get your kids any gifts over the holiday season — but consider the benefits of a carefully constructed holiday gift reward system. Kids could be rewarded for achievements in the classroom, the soccer field or helping the family with chores. Giving them exactly what they want, whenever they want, is a dangerous holiday season temptation. Avoid it like the plague. If you think that your kids will love you less because you don’t purchase something they’re begging for, realize that they’ll love you even less if you blow their inheritance on a whim.

2. Money can disappear in a flash

In a world where millions of dollars change hands every minute, nothing lasts forever — least of all, money. It can be lost in a heartbeat. Parents who don’t teach their kids these lessons risk raising adults who don’t appreciate the gravity of risk-taking with family savings.

On “Dragons’ Den,” I meet entrepreneurs obsessed with their business ideas. I love to see passion in businesspeople, but too much passion for a bad idea is a dangerous thing. I’ve seen entrepreneurs dump their life savings into hopeless ventures. I hate to see people killing money and I worry that the holidays are getting away with murder.

3. If you create a budget, you will discipline yourself

Try creating a maximum budget for everyone on your holiday shopping list. Under no circumstances should you exceed your pre-determined thresholds. Forcing yourself to live within a budget is an excellent exercise in discipline. If the year has been particularly good, you might allow yourself to increase the budget slightly. Total all of the spending so that you’re confident the ultimate number isn’t too much.

My mother taught me to never spend the principal of any investment. You can spend the interest on the principal, but never the principal itself. This is a great rule of thumb that works perfectly well during the first eleven months of the year. Why should your behaviour be any different during the holiday season?

4. Canada’s success is due to responsibility

The holidays are an excellent opportunity for reflection on the year that was. You could use the opportunity to take stock of your mistakes and pay down debts. If you do so, you’ll realize that Canadians are better off than a lot of people from other countries — so we shouldn’t squander our good fortune.

These days, it feels great to travel to other countries as a Canadian. If you leave this country and people know you’re Canadian, they kiss your feet. A big reason why people envy our economy is because we have something to teach the rest of the world about responsibility. With success comes the responsibility to act in a mature way. Our banks acted responsibly during the financial crisis and so should we, during the holidays. Even if it has been a good year, avoid the pressure to spend your all of your earnings over the holidays. If for no other reason, think of the children.

-- Kevin O’Leary

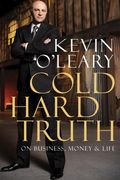

Kevin O’Leary is the much-feared and revered Dragon on the immensely popular show "Dragons’ Den" (and "Shark Tank" in the U.S.). Check out his new book Cold Hard Truth: On Business, Money & Life (Doubleday Canada, $29.95).

Posted by: Gerry | Dec 24, 2021 6:32:05 AM

Kevin,

You do have a heart under that tough exterior......What you say also makes environmental sense. Merry Christmas Kevin!

Posted by: dean | Dec 24, 2021 5:26:36 PM

Very good advice. I was brought up to be a hard worker and to value my time as much as money.

I am 43 have a paid for house, paid for vehicles and no debt. My wifes siblings have no idea what fiscal responsibility is. They made twice what I do have no money and rack up debt for their kids every xmas. Their adult kids are as dumb with money as they are. Very sad.

Posted by: DrVex007 | Jan 10, 2022 12:34:13 AM

I appreciate your commentary and much of it makes alot of sense, however it takes the magic out of a holiday season to some degree. Having said that, I believe in many of the same things you mentioned, and regularly implement them whenever possible.

Thank-you for being a common sense revolutionary in a crazy world Mr. O'Leary. It sure would be a great pleasure to meet you one day, although your time is of such value that is difficult to imagine. I am wondering if my product idea is worthy of Dragon's Den.... For the spouse who talks to much.....Crazy Glue ChapStick. There might be a trademark infringement in there somewhere though.