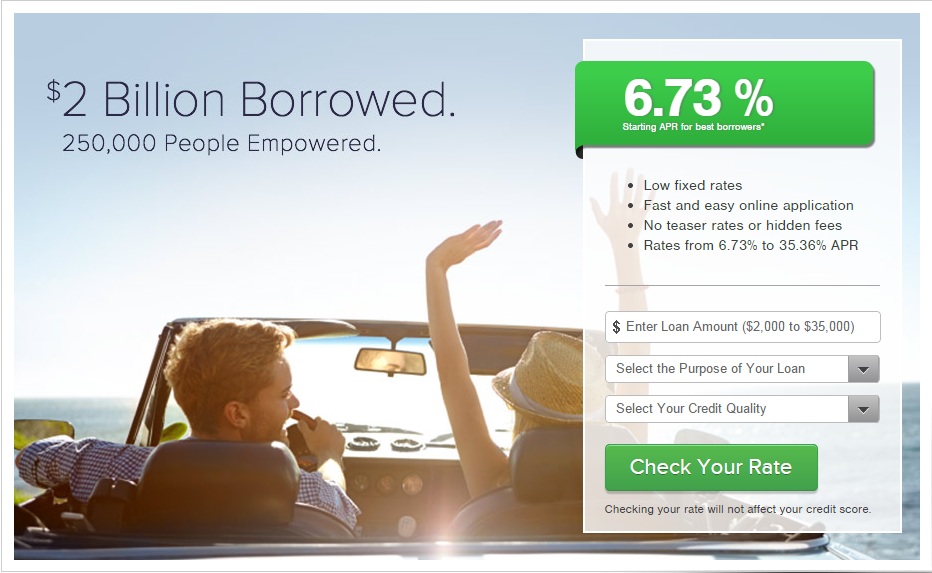

BEST PERSONAL LOAN RATES IN CANADA

Citi Canada (French: Citi Canada) is a unit of Citigroup of New York City. With roots in Canada dating back to 1919, the Canadian unit currently employs approximately 3,000 financial services workers in a range of consumer and institutional businesses.… Continue Reading